“Long before trustees, investors and regulators even thought there was a problem in pension-land, Ron saw the impending crisis. His warnings and solutions were ignored. The recommendations in this new book deserve serious consideration.”

—Frank J. Fabozzi, Ph.D.

Professor of Finance, EDHEC Business School and EDHEC Risk Institute

Winner of the 2014 IPPY Gold Medal

in the Finance/Investments/Economics category

Ron Ryan has been THE pension watchdog for more than 30 years. No one has been more insightful or outspoken. Institutional investors and individual pensioners would be wise to study his timely research and practical solutions.

Russell K. Mason

Founder and President

Founder and President, Investment Management InstituteNo one has exposed and documented the pension dilemma better than Ron Ryan. Wake up, America! Contribution costs are up 20 to 30 times since 1999 for most public pensions. Listen to the solutions he presents.

John D. Girard

Trustee

Boca Raton Police & Firefighters’ Pension Plan and Retirement System

Trustee, Boca Raton Police & Firefighters’ Pension Plan and Retirement SystemAmerica’s pension managers should have paid attention to Ron’s consistent warnings and research. It would have saved them from a deficit approaching 5 trillion!

Russ Kamp

Managing Partner

Ron Ryan on Bloomberg’s Taking Stock

Ron Ryan on The Larry Parks Show

America faces its greatest financial challenge since the Great Depression: The U.S. Pension Crisis!

• • • • • • • • • • • •

If the TARP I bailout was a national emergency at $800 billion, how should we describe the $4 trillion in unfunded liabilities that exists in public and private pensions across the country today? A devastating pension crisis looms as spiking contribution costs and promised benefit payments threaten the solvency of many corporations, cities, and states. This book details how improper accounting rules misled pension managers to follow the wrong objectives, leading to a financial crisis of epic proportions. Award-winning author Ronald J. Ryan details just how the pension crisis developed and what pension decision makers need to do now to solve this dilemma. He offers a compelling strategy to reduce pension costs and reach a fully funded status. This book is not only for pension and financial professionals and policy shapers, but also for employees whose pensions and retirement expectations are at gravest risk. Read it, and you will ask intelligent questions of your organization’s pension fund managers to find out what they are, or are not doing, to protect your pension.

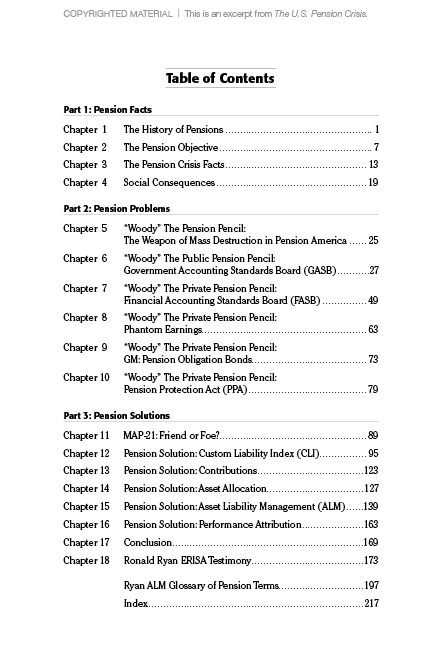

LOOK INSIDE: Sample pages from The U.S. Pension Crisis

From The U.S. Pension Crisis,

by Ronald J. Ryan:

“…When testifying before the ERISA Committee in 2003,* I brought in a five-foot pencil that I introduced as “Woody the pension pencil.” Woody is the weapon of mass destruction in financial America. Indeed, if you thought Enron and WorldCom had magic accounting pencils that led to their debacles, wait till you see what Woody has done to budgets, balance sheets, and income statements. This book will demonstrate how Woody is used in GASB and FASB accounting rules to reduce contribution costs, and enhance funded ratios, earnings, and balance sheets.”

*The complete testimony of Ronald J. Ryan before the ERISA Advisory Council is included in the text.

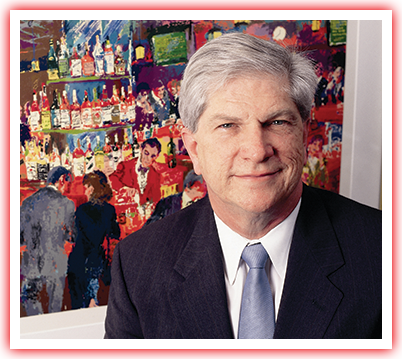

About the Author

Ronald J. Ryan, CFA

A recipient of the financial industry’s prestigious William F. Sharpe Index Lifetime Achievement Award, and many other industry accolades, Ron Ryan is a respected financial asset/liability expert. He is the CEO and founder of Ryan ALM, Inc., a bond asset/liability advisory and bond index firm that provides major financial indexes and strategies for pensions and ETFs. With a background that includes creator of three fixed income firms, director of research at Lehman Brothers, head of Texas’ largest fixed income trust department, and security analyst at Louisiana’s largest institutional investment entity, he is eminently qualified to sound the alarm on the state of the current U.S. pension crisis. Over the span of his 45+ year career, Ryan and his associates have designed and implemented numerous bond indexes and investment strategies.